Having an escrow account is a very helpful way to get through the home closing process, which consists of many sensitive elements. It can also be helpful after this process is over by helping you pay off your real estate taxes and insurance.

Here is how escrow in real estate works and what having an account can do for you!

What Escrow Accounts Do

Escrow accounts have two different purposes, depending on when they are used. They are used either before or after closing on a house.

Before Closing on a House

Before closing on a house, escrow accounts are used to hold your earnest money. Once a buyer finds a house and puts an offer on it, they give the seller an earnest money deposit.

The earnest money deposit is made to the seller and represents the buyer’s good faith to buy the home. The seller gets the keep this deposit if the buyer decides to break the deal or violates the contract.

Once the buyer puts an offer on the home and the seller accepts it, the earnest money deposit gets put in an escrow account. The deposit will be held in the escrow account until both parties close on the house. The deposit will then go towards closing costs.

After Closing on a House

After closing on a house, escrow accounts are mainly used to pay taxes and insurance.

The way this works is by applying for a mortgage. Once you apply and are approved, you will be given a loan estimate for your monthly payments based on principal, taxes, interest, and insurance.

Once you get this estimate, will have a good idea on how much you should hold in your escrow account and how much of that sum will go toward paying loans each month.

You will then be able to use an escrow account to store your monthly mortgage payments. So, when your taxes and insurance bill arrives, your escrow agent will use the money in your escrow account to pay off those dues.

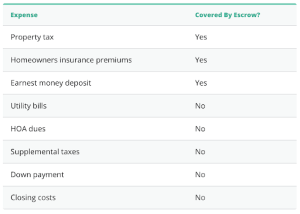

What Escrow Does and Doesn’t Cover

Here is a chart of what your escrow account does and does not cover:

Source: Credible

Get Started with New Venture Escrow

If you are looking to start an escrow account, we are here to help! Here at New Venture Escrow, we are here to meet all of your escrow needs. We have the resources and agents to ensure you have a smooth and easy escrow process.

To get started or find out more about the escrow process, contact us at New Venture Escrow!

Having an escrow account is a very helpful way to get through the home closing process, which consists of many sensitive elements. It can also be helpful after this process is over by helping you pay off your real estate taxes and insurance.

Here is how escrow in real estate works and what having an account can do for you!

What Escrow Accounts Do

Escrow accounts have two different purposes, depending on when they are used. They are used either before or after closing on a house.

Before Closing on a House

Before closing on a house, escrow accounts are used to hold your earnest money. Once a buyer finds a house and puts an offer on it, they give the seller an earnest money deposit.

The earnest money deposit is made to the seller and represents the buyer’s good faith to buy the home. The seller gets the keep this deposit if the buyer decides to break the deal or violates the contract.

Once the buyer puts an offer on the home and the seller accepts it, the earnest money deposit gets put in an escrow account. The deposit will be held in the escrow account until both parties close on the house. The deposit will then go towards closing costs.

After Closing on a House

After closing on a house, escrow accounts are mainly used to pay taxes and insurance.

The way this works is by applying for a mortgage. Once you apply and are approved, you will be given a loan estimate for your monthly payments based on principal, taxes, interest, and insurance.

Once you get this estimate, will have a good idea on how much you should hold in your escrow account and how much of that sum will go toward paying loans each month.

You will then be able to use an escrow account to store your monthly mortgage payments. So, when your taxes and insurance bill arrives, your escrow agent will use the money in your escrow account to pay off those dues.

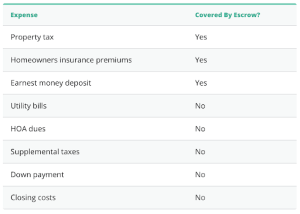

What Escrow Does and Doesn’t Cover

Here is a chart of what your escrow account does and does not cover:

Source: Credible

Get Started with New Venture Escrow

If you are looking to start an escrow account, we are here to help! Here at New Venture Escrow, we are here to meet all of your escrow needs. We have the resources and agents to ensure you have a smooth and easy escrow process.

To get started or find out more about the escrow process, contact us at New Venture Escrow!